by James Corbett

TheInternationalForecaster.com

December 1, 2015

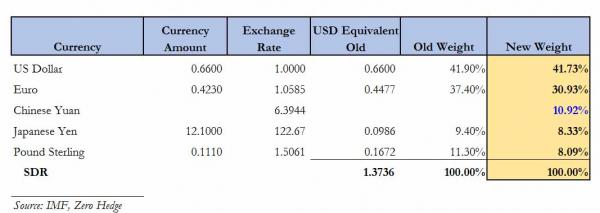

As expected, the IMF Executive Board has officially added the yuan to its Special Drawing Rights basket. The Chinese currency will enter the SDR basket from October 1st, 2016 and will be given a net weight of 10.92% of the basket, making it the third most valuable component of the SDR behind the dollar and the euro.

In a press release from the IMF Monday, Managing Director Christine Lagarde was quoted as saying:

“The Executive Board’s decision to include the RMB in the SDR basket is an important milestone in the integration of the Chinese economy into the global financial system. It is also a recognition of the progress that the Chinese authorities have made in the past years in reforming China’s monetary and financial systems. The continuation and deepening of these efforts will bring about a more robust international monetary and financial system, which in turn will support the growth and stability of China and the global economy.”

For those not conversant in globalist mouthpiece gobbledygook, Lagarde is essentially saying: “Good work, China! You’ve proven yourself to be pliant and flexible—a willing stooge for the globalist bigwigs. Here’s your seat at the table.”

As we’ve discussed before in these pages, the SDR is a reserve currency administered by the IMF. Central banks with SDRs in their reserve accounts can convert those SDRs into one of four currencies: dollars, euros, pounds or yen. As of next October, SDRs will also be convertible into yuan.

So what does this mean? It means that the yuan is now effectively a world reserve currency. Not the world reserve currency; that’s still the dollar, a position that isn’t likely to change for a few years yet. But regardless, the effect will be immediate and profound. Earlier this year AXA Investment Managers estimated that as much as a trillion dollars worth of Chinese bonds will be sold by the end of the decade as a result of the reallocation of global reserve assets that will take place because of this decision.

Inclusion in the IMF’s big boys’ club has not come without a cost, of course. In its scramble to live up to the SDR inclusion criteria of being “widely used” and “freely usable,” as well as to liberalize its financial system, China has experienced some enormous shockwaves in its economy this year. China’s moves toward interest rate liberalization and other measures designed to remove stringent government controls from the economy have exacerbated the problems in an already precarious economy. The liberalization measures have even been pointed to as one of the factors in China’s stock market meltdown this summer.

But ultimately the IMF’s decision should come as a shock to no one. The Chinese oligarchs have been fully on board with the New World Order agenda for generations, and the People’s Bank of China governor used the occasion of the Lehman Bros. meltdown to call for making the SDR itself the world reserve currency. And with the BRICS bank pledging cooperative action and sharing board members with the IMF itself, China’s fealty to the IMF world order is not really in question.

China has shown it can jump through the NWO hoops, and now it is receiving its prize.

So when is Russia going to show it’s hand? There’s a school of thought out there that has the Chinese turning on the Russians at the behest of the IMF and BIS, but as it sits, Russia is a part of the BIS, so do you think this is a move against Russia? How much of a role did Tianjin play in this move by the Chinese? Do you think Putin is on their list, or do you think he’s just playing his part in the Hegelian Dialectic?