In this week’s subscriber newsletter, James outlines the debt conundrum facing the Greek people–and the people of the world–as we stand at the brink of another economic precipice. Also, don’t miss this week’s recommended reading, articles and videos.

Not a member yet? Subscribe today.

|

The Corbett Report Subscriber

|

vol 5 issue 07 (February 14, 2015)

|

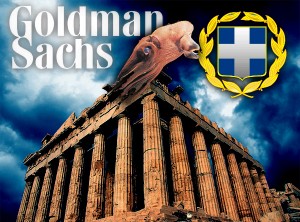

The Subscriber EditorialGreece At the Crossroads The Subscriber EditorialGreece At the Crossroadsby James Corbett corbettreport.com February 14, 2015 I don’t want to leave anybody in suspense, so let’s cut to the chase: Syriza is just the flip side of the austerity coin, and nothing they propose is going to fundamentally change the conditions that have led to the Eurozone’s systemic crisis. How do I know? Well, let’s imagine what the headlines would read if a truly paradigm-shifting, revolutionary party came to power in Greece. If there were a real revolution underway, we would be reading this on the news ticker: “New Greek PM: Greece to Withdraw From EU Immediately.” Instead we get this: “Greece will do ‘whatever it can’ to reach deal with EU: spokesman.” Or imagine this: “Greek Government Chides Brussels Over Ukraine Warmongering, Withdraws From NATO” instead of this: “Greece defence minister reassures NATO over Russia ties.” Or what if the newly sElected leader of Greece came out and said: “Fellow citizens, I bring you good news. This is the year of the great Jubilee! All debts shall be forgiven and all contracts annulled. You are free! Now go and prosper in peace.” Sound ridiculous? It shouldn’t. The concept of the Jubilee traces its origins back to Mosaic Law, specifically Leviticus 25, which records the notion of a “Year of Jubilee” every 50th year, in which slaves are freed and land returned to its original owners, and Deuteronomy 15, which commands, “At the end of every seven years you shall grant a remission of debts.” Although it has become common to think of these concepts as mere utopian ideals that were never actually put into practice, it is important to note, as economics professor Michael Hudson did in his groundbreaking 1992 study of “The Lost Tradition of Biblical Debt Cancellations,” that this tradition is now well documented in the archaeological record from Mesopotamia during the period preceding its recording in the Pentateuch. “Recent discoveries of Bronze Age Near Eastern royal proclamations extending from 2400 to 1600 BC throw a radically new light on these [Jubilee] laws,” Hudson wrote in his study. “Like their Biblical analogues, Mesopotamian royal edicts cancelled debts, freed debt-servants and restored land to cultivators who had lost it under economic duress. There can be no doubt that these edicts were implemented, for during the Babylonian period they grew into quite elaborate promulgations, capped by Ammisaduqa’s Edict of 1646 [BC]. Now that these edicts have been translated and their consequences understood, the Biblical laws no longer stand alone as utopian or otherworldly ideals; they take their place in a two-thousand year continuum of periodic and regular economic renewal.” Of course, all of this is well and good for a society of Bronze Age desert dwellers, but what does this have to do with a modern, complex, 21st-century finance economy? Surely this concept couldn’t apply in our day and age! Tell that to L. Randall Wray, Professor of Economics at the University of Missouri-Kansas City. Or popular blogger and equities analyst Barry Ritholtz. Or investment banker Chris Whalen. Or Stephen Roach, former chief economist at Morgan Stanley. They have all advocated for some version of debt jubilee, debt haircut, or consumer debt forgiveness. Debt forgiveness may hurt lenders, Roach told CNBC in 2011, but “they’re the ones who wrote the bad loans and they’re the ones who had the free ride. There’s no gain without some pain and we have to decide who in society has to bear the brunt of that.” For those who still doubt that such an idea could actually be put into practice, there’s always the example of Iceland . . . sort of. As anyone who has been following the news knows, Iceland’s overextended banking sector put the country in the front lines of the 2008 Lehman collapse and ensuing global financial crisis, which hit the North Atlantic island hard. Among the crises Iceland faced was a period of rapid inflation where its homeowners with adjustable mortgages saw the size of their mortgage increase as much as 30% in a matter of months. At the end of last year the Icelandic government tabled a plan, long discussed, to write off those additional mortgage debts incurred during the 2008-2009 inflationary period. The plan amounts to an average $11,000 of debt relief per household. The plan is far from perfect. Those who entered into mortgages before or after the cut-off for the program will receive nothing, while their neighbors who closed deals just weeks earlier or later will be receiving thousands of dollars. Others, like Baludur Hedinson, complain: “I had a student loan during that period, and that went up like crazy. I don’t see why they—if they’re doing this for mortgages, why don’t they do this for student loans, as well? So, I mean, I’m happy for [my friend] Heida that she’s getting it, but the overall thing—it feels very unfair.” But then, what can one expect from a half-hearted, one-toe-in-the-water implementation of an idea that itself is deeply radical and is meant to turn the economy on its head? The point of this digression is not the Jubilee itself, but what it represents: a paradigm shift in our thinking about the nature of the problem we face. Without a total, unflinching commitment to completely abandon the established rules of the game and transform society itself, how can the Greek people actually hope to free themselves of the debt chains that have been forged for them by their political “rulers”? For those unconvinced by the practicality of a true Jubilee and total forgiveness of debt, there is another concept that seems even more apt in this case: odious debt. This idea traces its origin back to the Spanish-American War of 1898, when the U.S. insisted that neither it nor Cuba was responsible for the debts wracked up by the colonial government without the consent of the people. Although the argument was not accepted, Spain did end up footing the bill for Cuba’s existing debt under the Paris peace treaty. Almost 30 years later, the principle of “odious debt” was formalized by Alexander Nahum Sack, a Russian professor of law:

Were a truly revolutionary party to come to power in Greece, would not hesitate to call out the debt of the previous Greek kleptocrats for the odious debt that it is.

Everything about this deal screams “odious debt.” It was struck by Christoforos Sardelis, the former head of the Greek Public Debt Management Agency, in secret, non-competitive negotiations with Goldman. It was illegal, a clear violation of the terms of the Maastricht Treaty. It was covered up and kept from the public, who is now supposedly on the hook for the deal. And yet Syriza and Tsipras are still willing to do “whatever it takes” to reach a deal with the EU so it can help pay down this (and the rest of Greece’s) fraudulent debt. The problem here is that debt itself is the problem. But as we all know too well by now, the very monetary system upon which our entire economic house of cards is built is based on debt-based central banker funny money. Governments issue debt in order to finance their operations, and no government that plans on issuing more debt wants to put itself in the position of being a government that renounces, forgives, or otherwise relieves debt, a process that their own creditors would not look kindly on. And make no mistake: Syriza plans on issuing more debt. The party’s original “40 point plan” is a bewildering mix of the obvious (“Equal salaries for men and women”), the unarguable (“Guarantee human rights in immigrant detention centers”), the laudable (“Use buildings of the government, banks and the Church for the homeless”), the bold (“Prohibition of speculative financial derivatives”), the questionable (“Adoption of a tax on financial transactions and a special tax on luxury goods”), the dubious (“Raise minimum salary to the pre-cut level, 750 euros per month”), the economically illiterate (“Raise income tax to 75% for all incomes over 500,000 euros”), and the truly revolutionary (“Closure of all foreign bases in Greece and withdrawal from NATO”). Guess which one was the first to be dropped before Syriza even came to power? If this “bold” and “exciting” new Greek government looks like more of the same, that’s because it is. Remember Alex Salmond, leader of the “Yes to Europe” “Yes to NATO” “Yes to the Pound” “Yes to the Queen” Scottish National Party. If he had won the referendum last year, would the average Scotsman have noticed any change at all other than a few less Union Jacks and a few more St. Andrew’s Crosses dominating the corrupt corridors of Holyrood? This is the crux of the issue: debt jubilees or odious debt write-offs will never seriously be on the table for a party like Syriza, because it is just another side of the same corporate fascistic system that governs nearly every nation in the world today. This system knows only two modes of rule: corporate welfare and social welfare. One involves a large, centralized, draconian, corrupt, inept Big Government that extracts the lifeblood of the masses from the economy and passes it along to Big Government’s friends in the corporate sector; the other involves a large, centralized, draconian, corrupt, inept Big Government that extracts the lifeblood of the masses from the economy and pass it to Big Government’s friends in the corrupt, bureaucratic welfare state apparatus. If someone were forced to choose to live under one form of this Big Government tyranny, of course the friendly “social welfare” state is preferable to the cold and callous “corporate welfare” state. At least in the social welfare state a few more scraps will fall from the master’s table and into the pockets of some people who can actually use it. But is this really the best we can do? And if not, how do we effect a true change? The real answer, as always, is to stop looking for a political savior to save us from the mess caused by the previous political puppets. This endless revolving door of politicians of the left and the right is admittedly a ruse to lull you into submission, making you believe that you always have the power to “throw the rascals out” when in truth you are doing nothing but voting in more rascals. The real promise of hope is in stories that have (unsurprisingly) almost completely fallen under the radar of the establishment media. Like in Volos, where hundreds of Greek businesses began their own barter exchange currency, the TEM, to keep the local economy going when euros were drying up and business was grinding to a halt. Now over 1,200 members of the network, including teachers, doctors, farmers, babysitters, hairdressers, and other local businessmen and women, are transacting with each other in TEM, not in euros, and are planning to expand the idea to other communities.

Of course, the study of the concept of “Jubilee” is not complete without an understanding of its etymological origins. The Year of Jubilee was announced by a blast from a ram’s horn during Yom Kippur, and the word “Jubilee” in English is thought to derive from the Hebrew yovel, meaning “a trumpet-blast of liberty.” This is what lies at the root of Jubilee: a blast of liberty. And this is the answer to the so-called “sovereign debt crisis.” Sadly, the trumpet-blast of liberty has not sounded from Alexis Tsipras’ horn, and it never will. As long as our economies rely on government-created funny money and ever-mounting piles of debt that forge chains of servitude around generations not yet born, we will never have the liberty required for a Jubilee, or for a fundamental change in our current system. And until that trumpet sounds, all that will happen is the shuffling of deck chairs on the EU Titanic. |

Recommended Reading and Viewing

Recommended ReadingMore Icelandic Bankers Going to Prison – mbl.is Recommended ListeningBias in Scientific Research (+ Correcting the Scientific Record) Recommended ViewingI’m a Truther… I’m a Republocrat Just For Fun |

While James may be and probably is correct in his assessment of what Syriza can accomplish by staying on good terms with the banking matrix I won’t right them off just yet. They have yet to fully feel their way with their new found control on the levers of state power and I will cut them some slack during this probationary period. Syriza party brass must also know that they are treading on the thin ice of history according to the powers of the universe, and not wanting to re commit the errors of “Z”, may well be pacing the introduction of more radical measures as the best part of valour.

Those not familiar with the Greek “Z” revolt against the then NATO imposed military junta might be able to find a copy of the film of the same title, produced I believe back in the early 7Os or there about as one way of discovering what that movement was about, and what Syriza must avoid replicating.

Thanks for the feedback as always, bladtheimpailer. For what it’s worth, I hope you’re right and Syriza really are political saviours in disguise descended from heaven to save Europe from the clutches of the banksters. But then again a lot of people hoped that about Obama and look where that got us. Personally I’m done waiting for political saviours or believing that any politician who is playing the game or “pacing the introduction of more radical measures as the best part of valour” will ever change anything. Change starts and ends with the people, period.

I hear they have pledged never to ratify TTIP, which sounds good. I hope also that the Greek people will have some power to hold them to account.

Thanks for the reply. You are correct. I just wrote “Dumfries” in the first draft because I couldn’t remember Holyrood, and then I forgot to amend it in editing. It’s changed now.